The housing crisis has the potential to set off a chain of events to increase the overall rate of unemployment, poverty and homelessness, and eventually lead into a generalized economic recession.

The housing recession has led to the loss of 500,000 jobs—primarily in the financial services, construction, raw

|

Bourgeois economists started off calling it a slight “correction,” and then a “slump,” but now they are beginning to debate whether the economy is headed towards recession and crisis.

For those who have already had their homes repossessed by the banks, this economic crisis is already real and tangible. Like all widespread crises in this country, oppressed communities have been disproportionately affected.

In New York City, where new housing complexes and condominiums are built seemingly overnight, 100,000 people experience homelessness each year. According to a Coalition for the Homeless report, 38,000 people sleep in a New York City shelter every night, including 16,000 children. Thousands more sleep in the streets and subways.

What is more disgraceful is the fact that 90 percent of all homeless people in New York City are either Black or Latino, although they constitute only 53 percent of the city’s population. Collectively they are the visual evidence of the criminal and racist nature of the capitalist system.

Most New Yorkers—whether homeowners or renters—spend more than half of their income trying to keep a roof over their heads. Those who aspire to buy homes hope to build assets and credit. Others use their home as a retirement investment they can sell and live off of when it comes time to leave the workforce.

A foreclosure is when a bank (or creditor) repossesses the home of an individual or family who has defaulted in payment. The bank or creditor takes back the property and sells it, as if it were never occupied and no one ever lived there or called it home. It does not matter how long a family has lived in the property or how many tens of thousands of dollars they have paid towards homeownership; if they cannot make the payments, they will lose their homes.

Across the country, the foreclosure rate has increased 94 percent since last year and more and more homeowners are falling behind on their payments. A Congressional estimate puts 2 million homeowners with subprime mortgages at direct risk of losing their homes in the coming year. African Americans hold more than half of these subprime mortgage loans at risk of foreclosure, according to the NAACP. The introductory “teaser” rates for subprime loans expire this year, meaning that many subprime loan mortgages holders will be faced with higher monthly mortgage payments.

Black and Latino homeowners are often forced to pay higher-cost home purchase loans to initially obtain a mortgage. An analysis by the Neighborhood Economic Development Advocacy Project showed that African American borrowers in cities like New York, Los Angeles, Chicago and Boston were more than 12 times as likely to be issued higher cost home purchase loans as white borrowers. Latinos buyers were eight times more likely than white buyers.

These high priced startup loans are the only access to homeownership for borrowers of color, but they end up paying more for their mortgages than their incomes justify, preventing them from having any type of savings or building good credit.

In addition, Blacks and Latinos are particularly subjected to predatory subprime loans, which were brought on by the overproduction of houses. Essentially, loan companies prey on aspiring homeowners of color, immigrants and the elderly who cannot afford to invest in high home purchase loans. These subprime loans offer low introductory interest rates, but after a few months or years, they jack up the prices, leaving unable to pay their mortgages.

It is no surprise that oppressed communities are being hit hardest in the foreclosure crisis. The collective economic status of African Americans directly corresponds to their historical exploitation. African Americans suffer the highest unemployment rate of all ethnic groups at over eight percent. They fare poorly in every indicator of well-being: economic, social, educational and political.

The mean income of African Americans as a group is 65 percent that of white people, and by very moderate estimates, a third of all African Americans live below the poverty level.

No ‘bailout’ at all

Analysts have said that they expect the foreclosure rates and late mortgage payments will remain high in the upcoming quarters. While the Democrats and Republicans continue to point fingers at each other, the Federal Reserve will continue its attempts to rescue the banks—which are portrayed as victims in this crisis—by lowering short-term interest rates.

On Dec. 6, the Bush administration made public that they were close to making a deal with the banks and mortgage companies in order to ease the mortgage crisis. The plan would freeze the mortgages of some subprime borrowers at the introductory teaser rates for three to five years. Ironically, this coalition of banks and is calling itself the Hope Now Alliance.

But to qualify for this mediocre type of help, borrowers would have to already be current on their payments and be able to continue paying at the current rate. The real estate companies judge each borrower on a case-by-case basis. A similar plan has already been enacted in California; only 12 percent of those at risk of foreclosure have qualified for the modified mortgages.

Essentially, this plan for alleviating the foreclosure crisis keeps all decision-making power in the hands of the real estate moguls. Those who have already fallen behind on their mortgages, or will soon fall behind, still will lose their homes. The corporations voluntarily participating in the Hope Now Alliance are doing so because it is a profitable endeavor, not out of sympathy for their debtors.

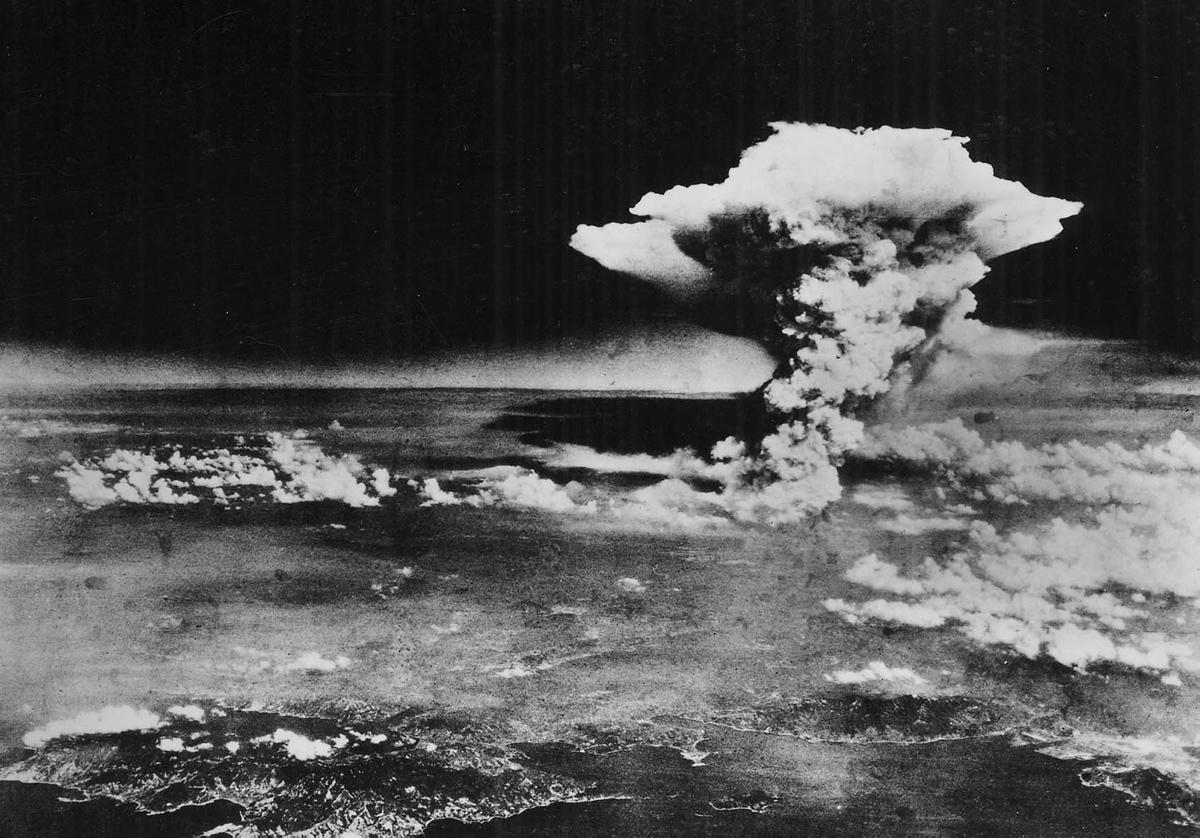

The contradictions of capitalism are evident in times like these. There are hundreds of thousands of homeless people and millions of others at risk of losing their homes to foreclosures. All of this has taken place in the midst of—and as a product of—a housing market surplus. The inventory of unsold homes is the largest it has been since the post-World War II period.

The Party for Socialism and Liberation holds firm to the conviction that housing is a right for all. We call for a moratorium on all repossessions and foreclosures, and we fight for a society that operates on the basis of meeting people’s needs, not for private profits.