Back on Jan. 4, President Bush convened a meeting in the Oval Office of a little-known group of top financial chiefs. The President’s Working Group on Financial Markets, otherwise known as the “Plunge Protection Team,” was created after the 1987 stock-market crash. This “team”—long kept secret—was last mobilized to calm the markets after Sept. 11, 2001.

The group is led by Treasury chief Henry Paulson, formerly head of investment-banking powerhouse Goldman Sachs,

|

International business editor Ambrose Evans-Pritchard of the British Telegraph reported the following week in an article headlined “Bush convenes Plunge Protection Team” that “the New Deal of 2008 is in the works.” The U.S. Treasury “is about to shower households with rebate cheques to head off a full-blown slump,” he predicted. (Telegraph, Jan. 8, 2008)

Sure enough, both President Bush and congressional leaders soon began touting tax rebates as a key feature of the quick fix they hope can stave off a recession.

Only a little more than two weeks later, on Jan. 24, Associated Press reported:

“Congressional leaders announced a deal with the White House Thursday on an economic stimulus package that would give most tax filers refunds of $600 to $1,200, and more if they have children.

“House Speaker Nancy Pelosi said Congress would act on the agreement—hammered out in a week of intense negotiations with Republican Leader John A. Boehner and Treasury Secretary Henry Paulson—‘at the earliest date, so that those rebate checks will be in the mail.’”

The “stimulus plan,” naturally, would “allow businesses to immediately write off 50 percent of purchases of plants and other capital equipment and permit small businesses to write off additional purchases of equipment,” according to AP. The total cost of the package is estimated at $100 billion for the rebates and $50 billion for the business tax cuts. The House passed the package with large bipartisan support on Jan. 29 and is being discussed by the Senate.

While Nancy Pelosi and other Democratic congressional leaders agreed to what amounts to extremely reactionary form of Keynesian measures on top of the huge tax cuts already in affect—notably absent was any serious push for a major program of public works. This is real betrayal of the people—especially the largely African American population in New Orleans.

The Federal Reserve, the U.S. central bank, got into the act just before the U.S. markets opened on Jan. 22, 2008, announcing a surprise 0.75-percent cut in the official target for the overnight lending rate between banks known as the federal funds rate. The unusual timing (a regularly scheduled meeting of the Fed was to take place Jan. 2930) and the magnitude of the cut suggested that the panic on display in the markets around the world had spread to the Fed itself.

The move enables the Fed to greatly expand bank reserves—and therefore banks’ lending capacity—by buying up treasury securities on the open market. Short-term interest rates have fallen as a result.

As of this writing, it remains to be seen what the true scope of the “New Deal of 2008” will turn out be. But this much is clear: The most powerful circles of finance capital had already worked out the main outlines of what they wanted their political representatives to implement—and without delay! Both Democratic and Republican lawmakers, along with Bush, have moved with uncharacteristic speed to meet the demands of their real constituency.

The question is, however, will these measures work, or is a major crisis beyond the powers of finance capital and its bought-and-paid-for government to head off? And if the latter, what form is such a crisis likely to take?

Economic crisis deepens

Government officials and leading politicians have been pretending that a “stimulus package” will head off a downturn. Many signs, however, point to the U.S. economy having already slipped into recession:

- The official rate of unemployment is rising quickly. The real rate, if undocumented and discouraged workers were fully counted, is no doubt rising even more quickly. Before December 2006, there were nine cycles in the United States since 1950 in which the annual increase in the number of unemployed workers hit 13 percent or higher. In each case, a recession had already begun or was imminent. The December number of unemployed was 13.2 percent higher than the 6,760,000 jobless reported for the previous December. (nytimes.com, Jan. 19)

- In November 2007, nearly 1.4 million people—almost one in five of those unemployed—had been jobless for at least 27 weeks, the juncture when unemployment insurance benefits end for most recipients. That is about twice the level of long-term unemployment before the 2001 recession. (Washington Post, Jan. 21)

- The credit market meltdown that shook the biggest financial institutions in August 2007 shows no signs of bottoming. New home construction has already fallen by some 40 percent since the peak in 2006. New home sales have fallen even faster. Home prices have dropped by about 7 percent since the peak in 2006, but some experts suggest they could fall by another 15 to 20 percent before hitting bottom. (nytimes.com, Jan. 13)

- Foreclosures and evictions are soaring. A new report says the subprime mortgage crisis will cause African-Americans to experience wealth losses of between $72 billion and $93 billion over its duration. For people of color in general, the racial bias of subprime mortgage lenders accounts for nearly double the wealth losses for people of color as for whites. (faireconomy.org/dream)

- The crisis in subprime mortgages, the initial core of the financial meltdown, has spread to credit card debt, car loans, and other forms of consumer debt, further undermining the solvency of the big lenders and the big banks, hedge funds, pension funds, and other financial institutions that loaded up on supposedly low-risk securities backed by the interest payments on such debt. The number of credit accounts that were 60 days delinquent, or had been charged off already, increased in November 2007 from the previous month. More important, the pace of deterioration had increased from previous months. (businessweek.com, Jan. 4)

- Retail sales are declining in many areas of the country. Associated Press reported Jan. 16: “Consumers cut back on their spending at the nation’s retailers in December, wrapping up the weakest sales year since 2002, according to a gloomy [Commerce Department] report that fanned fears of a recession.”

- City and state revenues are falling. The biggest drops have occurred in New Hampshire, Rhode Island, Florida, Ohio, North Caroline and Nevada. (stateline.org, Jan. 16) California governor Arnold Schwarzenegger has called for a 10-percent across-the-board cut in state spending to address that state’s $14.5-billion budget shortfall. The resulting cutbacks will hit working-class people the hardest.

Market rollercoaster

Meanwhile, world financial markets have been gyrating wildly, reflecting a growing sense of panic among investors and speculators. Within these gyrations, however, the trend has been decidedly negative, or “bearish” in the language of Wall Street. The Dow Jones Industrial Average, after reaching an all-time record high in early October 2007, had fallen nearly 20 percent by the third week of January.

One of the most notorious and successful of the big speculators is George Soros. He is the chairman of Soros Fund Management and the Open Society Institute and is also a former board member of the Council on Foreign Relations. His support for the “trade union” Solidarity in Poland, as well as the Czechoslovak “human rights” organization Charter 77, helped bring about the overthrow of socialism in Eastern Europe and the Soviet Union. On BookTV, Nov. 12, 2007, he endorsed Barack Obama for president, but said that John Edwards, Hillary Clinton, or Joe Biden were all fine candidates, as well.

With an estimated current net worth of around $8.5 billion, Soros is ranked by Forbes as the 80th-richest person in the world. Here is how he described the current crisis in an article published in the Jan. 22 Financial Times:

“What started with subprime mortgages spread to all collateralised debt obligations. … The asset-backed commercial paper market came to a standstill and the special investment vehicles [Enron-style entities] set up by banks to get mortgages off their balance sheets could no longer get outside financing. The final blow came when interbank lending, which is at the heart of the financial system, was disrupted because banks had to husband their resources and could not trust their counterparties [other banks]. The central banks had to inject an unprecedented amount of money and extend credit on an unprecedented range of securities to a broader range of institutions than ever before. That made the crisis more severe than any since the second world war.”

No wonder finance capital is scrambling to stem the financial hemorrhaging. But how much more will the captains of finance be able to do?

Systemic collapse?

The initial reaction of the U.S. bond market to the announcement of the stimulus package was distinctly negative. But if

|

The “New Deal of 2008” is sure to fall far short of the original “New Deal” under President Franklin Roosevelt. The United States’ economic position in the world now is far weaker than it was in the 1930s. It has gone from being a creditor country to being the biggest debtor country in the world. And U.S. industry has been in a long-term decline that shows no signs of reversing.

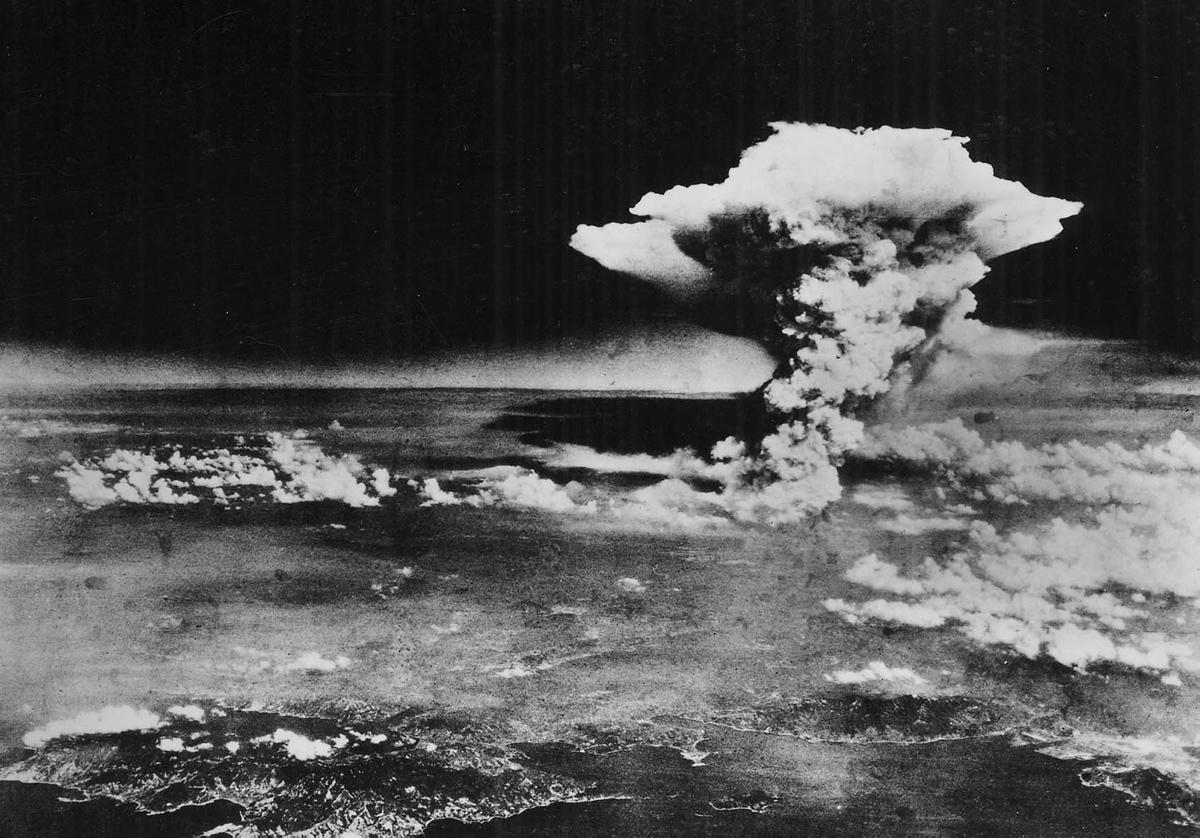

It is worth remembering that Roosevelt’s “New Deal” too did not end the severe economic depression. In 1938, in spite of massive government spending aimed at stimulating a depressed economy, the U.S. economy crashed again. It was only the U.S. entry into World War II that ended the crisis of mass unemployment. The conversion of the civilian economy into full scale military production, and the creation of a conscript army of millions, allowed the U.S. economy to emerge from a decade of unemployment and depression.

Desperate times and fear: a hallmark of instability

George Soros was one of the attendees of this year’s World Economic Forum in Davos, Switzerland. In a Jan. 25 New York Times article, Floyd Norris takes up Soros’s proposal for dealing with “risks from credit default swaps [a form of credit insurance], which have become a $45 trillion business.”

“[I]t was interesting, Norris writes, “because of the extent of fear it showed.” Norris continues:

“He wants bank regulators to go in and audit the big financial institutions, and then either close them down or give them clean bills of health, with explicit guarantees of their positions. Then traders would know some counterparties were safe.

“That such an idea could cost the Treasury billions, or give big financial advantages to the favored banks, or even amount to practical nationalization, did not seem to bother Mr. Soros. He is worried about the possibility of ‘systemic collapse.’”

Bourgeois economists and economic journalists ranging from right-wing monetarists to liberal Keynesians are pinning the blame for the current crisis on bad policies.

One claim is that former Fed chief Alan Greenspan lowered interest rates excessively during the previous recession, sparking the housing bubble whose popping led to the present crisis.

Current Fed chairman Ben Bernanke has been criticized for being “behind the curve” and not quickly enough lowering interest rates to head off the present crisis.

Another claim, for example by Robert Kuttner, founder and co-editor of the liberal American Prospect magazine, is that the crisis is due to right-wing-driven deregulation of the financial markets and the economy as a whole.

This last claim is ironic in light of the fact that the stagflation crisis of the 1970s was blamed by right-wing forces on too much regulation. That sparked a decades-long deregulation drive that began during the Carter administration.

The thrust of such “explanations” of capitalist crisis is to blame faulty policies on the part of central bankers and governments rather than the capitalist system itself. In reality, that system is crisis prone regardless of the policies followed. At most, government and central bank policies can affect the form and timing of an economic crisis but cannot prevent the crisis itself.

In the potentially unprecedented crisis now developing, millions of workers face loss of jobs and homes plus soaring prices. While organized labor and community organizations need to fight for measures that soften these blows, it’s the system itself that must be abolished and replaced with one based on human solidarity and socialist planning.