Since winning re-election President Barack Obama has been taking a seemingly more aggressive approach towards his Republican opponents during “fiscal cliff” negotiations. Most notably he has declared that without some increase in taxes on the wealthiest American’s he will refuse to strike any bargain. In particular Obama is proposing $1.4 trillion in tax increases mostly raised through allowing Bush tax cuts for the top 2 percent wage earners to expire, plus some rise in taxes on investment. Additionally the President is proposing around $600 billion in tax cuts.

In an attempt to press his advantage Obama has taken his campaign on the road, urging supporters to take to their keyboards and phone-lines to pressure their representatives in Congress to back his play. The President has sought to link his fiscal cliff negotiations to the plight of working people in the United States by continually underlining that, by going over the fiscal cliff, working families could face thousands more in taxes, while the rich will continue not to pay their “fair share.” He even gave a speech from a Detroit factory floor denouncing “Right-to-Work” legislation in Michigan while plugging his tax plans.

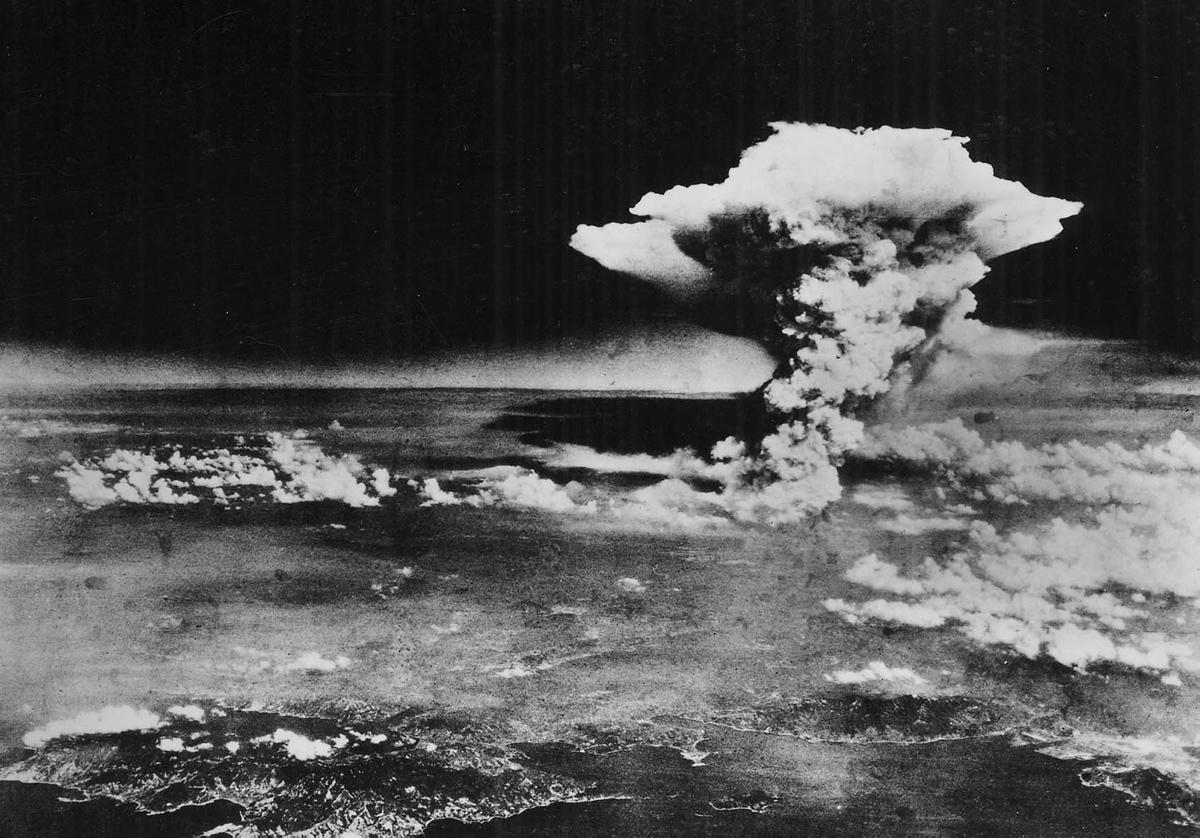

After spending the entire election campaign comparing any tax rise to Armageddon, Big Business now appears to be backing the President’s negotiating position. The CEO of Goldman Sachs declared the proposal to be a “very credible” “concession to reality.” When it comes to tax increases on the rich, JP Morgan Chief Jaime Dimon declared “I don’t personally care, ok?” Fred Smith, FedEX CEO and top Republican, even declared that the idea that tax hikes could hurt the economy to be “a lot of mythology.”

The Business Roundtable—a trade association for big corporations—even resorted to biblical rhetoric while implicitly endorsing the broad outline of President Obama’s proposal. Even far-right pundit Ann Coulter has said Republicans should accept Obama’s proposals, telling Sean Hannity: “We lost the election.”

What’s really happening?

How does one account for what appears to be a sea change in the minds of capitalists and their reactionary mouthpieces? Could it be divine intervention? Clogged inboxes? A quick glance at some of the lesser details of the negotiations reveal that in fact the seeming backpedaling by Big Business and some right-wing figures is nothing more than a tactical retreat.

It would seem that the White House and the business community agree that individual tax rates should go up, while corporate rates should go down. This would take place in two stages, first by making a deal this year on personal income taxes, followed by lowering corporate rates during the next Congress in 2013.

Dimon, among others, has said individual tax increases on the wealthy must be linked to “spending restraint.” Not coincidentally Obama declared that he was open to raising Medicare eligibility from 65 to 67 years of age although he acknowledges it will do very little to actually reduce Medicare costs. In other words the administration is willing to sacrifice healthcare for the elderly to the whims of Wall St. billionaires in the name of “compromise.”

The entire framework of the debate distorts reality. Obama’s proposals, portrayed by both the media and business as significant, are in fact rather timid. If the President has his way, tax rates for the highest-income earners will be about 39 percent. In contrast, in 1956, during the most prosperous period in U.S. history, they were 90 percent.

Thus, even if the proposed increases pass, the super-rich will continue to rake in almost all the wealth percentage-wise.

Take Dimon of JP Morgan. In 2011 he was paid $23 million, most of it in stocks and options. In that same year he claimed—falsely—that with federal and state taxes people like him pay about 50 percent of their income in taxes. If that were true, and it is not, that would mean instead of $23 million, he would take home just over $11 million. The average lifetime earnings of someone with a college degree are just $2.7 million. So that means, even by his own fraudulent tax estimates, Dimon made roughly five times more in 2011 than the average college graduate in his or her entire life.

This demonstrates perfectly why the Democrats are often the preferred vessel for the plans of U.S. capitalist rulers. After a year where big business heaped invective on Obama, claiming his most modest of proposals were extreme left-wing policies, the abrupt switch gives the appearance that the President has forced the super-rich to make significant concessions. This creates the appearance of a narrative that elections work. It would appear that the “right” President, with a little help from his supporters, can really “make the rich pay.”

The real story behind the fiscal cliff campaign is simple: it is a trick.